The origin, caliber & potential of Vietnamese IT talent

Building, investing & exiting in Southeast Asia

Vietnam's information technology sector has experienced remarkable growth over the past two decades, evolving into a significant contributor to the country's economic development. This growth has been underpinned by a considerable talent pool, robust educational systems, and supportive government policies. From a broader perspective, the Vietnamese IT engineering talents constitute approx. half of the larger general engineering graduate talent pool of the country (there are ca. 100,000 engineering graduates per year in Vietnam). To me, this engineering talent pool has long been the number one asset of Vietnam.

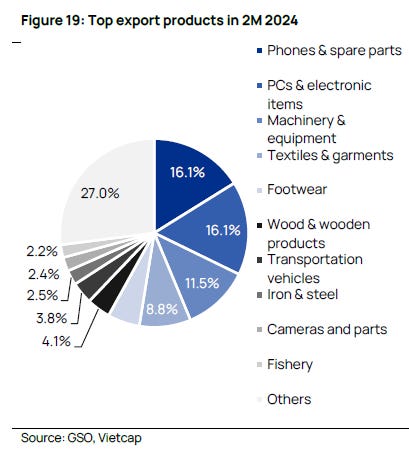

The country’s well-educated, cost-efficient and hard-working engineering talent pool is the primary attraction for large groups of foreign companies that invest into Vietnam. Most surveys will place Vietnamese engineers at ca. 1/2 to 1/3 of the cost of a Chinese equivalent. The attractiveness of the Vietnamese engineering talent pulls foreign capital to invest into onshore engineering-centered manufacturing, which in turn has vast ripple effects on the employment of thousands of additional factory workers around the engineers. The attractiveness of the local engineers is hence the bedrock of a core part of the Vietnamese growth model - the foreign-invested and engineering-focused exports. Approx. 45% of Vietnamese exports are either smartphone & electronics or machinery components today. Other, more traditional product categories, such as textiles, footwear and furniture are much smaller drivers (each ca 5-10% of total exports). In this sense, the Vietnamese export and growth model carries great resemblance to the ones of Japan, South Korea and Taiwan.

“Approx. 45% of Vietnamese exports are either smartphone & electronics or machinery components today.”

Decades of rapid growth, with >0.5 million “Devs“ on the frontline

The Vietnamese educational system has focused on engineering-focused subjects for decades and since the early 2000s Vietnam's IT sector has witnessed exponential growth. The sector’s total revenue has increased by 400x during the two decades from 2000 to 2020 (compounding at 35-40% p.a. for two decades), ultimately positioning Vietnam as the key player in ASEAN for software and IT services. By the early 2020s, the sector's contribution to the nation’s economy was not just significant in terms of share of GDP, but also in terms of catalyzing broader economic transformation. Vietnam today is home to approximately 550,000 IT-engineers. This pool is predominantly composed of younger generations, with a significant representation from Gen Z and Millennials - much more so than IT talent pools in “older economies“, such as China and Russia, which in turn speaks to the dynamism and forward-thinking capabilities of the Vietnamese IT engineering workforce.

Educational infrastructure

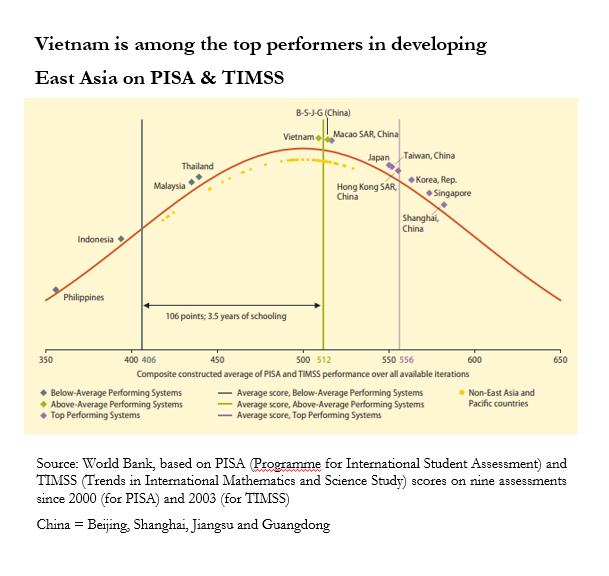

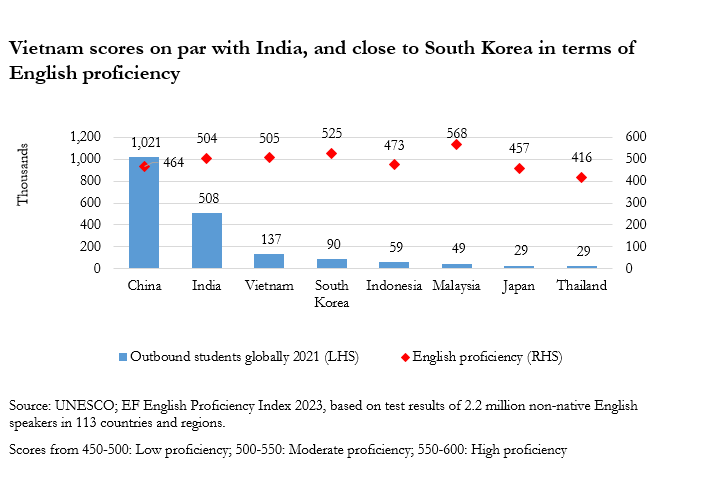

Vietnam's emphasis on IT education has been a key growth driver for the local engineering talent pool, resulting in ca. 50,000 IT engineering graduates annually. The local popularity of educations within STEM (Science, Technology, Engineering and Mathematics) has been a core reason for the successful development of the Vietnamese IT engineering talent pool and there are still multiple government initiatives aimed at increasing the proportion of university students in these fields. As in most countries however, there is still a partial misalignment between what is taught in academia and what the industry is looking for in a fresh graduate. However, a young and hungry talent pool is most often able to adjust and adapt to bridge that gap, especially when incentivized by the potential salary evolution from fresh graduate at ca. 500 USD gross per month, to a specialized senior engineering for a foreign employer at ca. 5,000-7,000 per month. Similarly, the combination of a strong engineer with a high degree of proficiency in English (or Japanese or Korean) is often what the most prominent foreign employers are looking for. Also along these added dimensions, the Vietnamese engineering talent pool scores high. Vietnamese schools offer foreign language (English being the most popular one) as a compulsory requirement for all students, all the way from Year 3 to university (and this has been the case since the early 1990s). In addition, Vietnam ranks number three on the planet when it comes to the absolute number of students studying overseas (right after the only two countries with more than 1 billion people each, and with e.g. twice the number of students of Indonesia that has roughly 3x the population of Vietnam). This in turn constitute a large and nowadays often returning brain pool for the country to pull from.

The potential and the pitfalls

While the growth narrative is strong, the sector also faces its challenges. One of the most pressing being talent shortage in certain more niched subsegments of software development, e.g. AI, Cybersecurity, and Cloud Computing. The demand for skilled professionals in these areas is rapidly outpacing the supply. However, one should keep in mind that this is the case in more or less every IT talent market in the world. The critical determinant of success is not the surplus availability of talent (in e.g. AI, it’s more or less negative in every country at the moment), rather it’s the ability to educate and upskill engineers that is the critical path. Vietnam's government has set ambitious targets for its IT sector, aiming for 100,000 digital technology enterprises and 1.5 million employees in the digital field by 2030. Achieving these goals will require not only sustaining the growth momentum but also addressing the existing gaps in talent development, gender diversity, and alignment between education and industry needs.

Moreover, the cost-effectiveness of Vietnamese IT talent, while currently a competitive advantage, will face pressures from rising wage expectations and international competition. Local salary inflations in the 10-15% p.a. range is not uncommon in the sector, which might be hard to stomach for a American or European investor looking to enter. Obviously, the key for this to be sustainable is for productivity increases to follow similar annual growth rates, which can only really happen with a strong upskilling focus from both talents and IT engineering companies alike.

From a personal on-the-ground perspective

I have personally had multiple great experiences working hands-on with Vietnamese IT and tech talents the past decade plus. Early on when I moved to Vietnam to build out Lazada, we quickly realized that the Vietnamese IT engineers were equally good to their German, Russian and Chinese counterparts (which we also had on the payroll). Hence, it didn’t take long before we centralized all the group’s IT development resources into a large tech hub employing 100s of Vietnamese IT engineers in central Saigon. Later on, when I had left Lazada, we built out two IT outsourcing companies in Vietnam - one called Fram IT-development and the other one called Pangara, together employing 100-200 local developers. These were great positive experiences that we later exited during 2022 and 2023 in order to be able to focus on other company building.

Sources:

https://kyanon.digital/vietnams-it-workforce-a-growing-industry-with-endless-potential/

https://techvify-software.com/the-growth-of-it-industry-in-vietnam/

TopDev’s Vietnam IT Market Report 2023

https://www.statista.com/statistics/1308259/vietnam-number-of-it-graduates-versus-number-of-qualified-graduates/

https://cmcglobal.com.vn/it-insights/vietnam-it-talent-pool-a-force-to-be-reckoned-with/

https://inspius.com/insights/top-vietnams-universities-in-computer-science-and-it-related-majors-2024-centers-of-excellence-for-future-software-engineering-leaders/

https://en.vietnamplus.vn/vietnam-requires-policies-for-highquality-stem-education/270493.vnp

https://link.springer.com/chapter/10.1007/978-3-031-37387-9_20

https://vietnamembassy-usa.org/news/2000/11/information-technology-development-vietnam

https://fullcircle.asu.edu/outreach/asu-intel-help-modernize-higher-education-in-vietnam/

https://builditvietnam.org/sites/default/files/2021-08/FS_BUILDIT_AUG%202021%20ENG%20%20Submitted%29.pdf

https://www.econstor.eu/handle/10419/193766

https://employers.glints.com/en-sg/blog/tech-talent-focus-why-vietnams-tech-talent-is-the-most-sought-after-in-southeast-asia/

https://vietcetera.com/en/vietnam-fdi-in-2022-biggest-investors-and-top-recipients

[1] https://masangroup.com/news/invest-in-vietnam/vietnam-investment-opportunities-in-technology-and-innovation-a-rising-star.html

[1] https://techvify-software.com/the-growth-of-it-industry-in-vietnam/